In May of this year, Zamora became the first city in Spain to

enforce that the Catholic Church pay the Property Tax (IBI). Through

the adoption of this measure, the local government of Zamora is trying

to reduce the deficit that affects so many local Spanish councils.

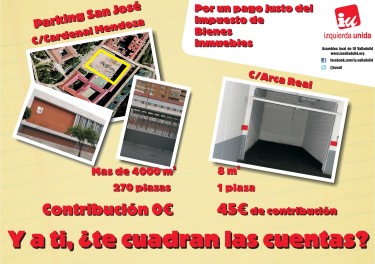

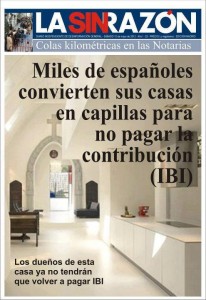

Social networks have captured information and a variety of comments on the topic. People have become angry after finding out that the Church, owner of the most real estate, does not pay all the corresponding taxes.

Who is lying? In reality, everyone and nobody. It's the typical case of information being manipulated so that everyone can work things to their own advantage.

There are a series of buildings that are exempt from paying the IBI tax. In the Church's case, the agreements with the Santa Sede [Vatican] IBI have exempted the buildings dedicated to the intrinsic work of the Church (pastoral, educative, administrative, hospitality, welfare…).

The Patronage Law exempts buildings owned by not-for-profit entities from paying the IBI, except those that have economic activities submerged in other taxes. If we consider, as an example, the new rule from the council of Zamora, see the article in Economista.es [es], it helps us to understand the differences a little more:

With regards to the council tax rates, the same article clarifies:

With a certain threatening whiff, Isidro Catela, from the Episcopal Conference previously mentioned, says:

In this way we can verify that only a very small part of the total funds that Cáritas manages, comes from the church as an institution in the form of contributions from the Interdiocesan Fund and from diocesan organisations.

In the 2010 statement, specific donations from these institutions do not appear, perhaps because they appear in another section, or simply because they do not exist altogether.

In any case, having seen these figures, it does not seem that Cáritas has any reason to be worried [es] if the Spanish councils decide to enforce the Church to comply with their tax obligations.

It should be noted that in February of this year, the Italian government approved the imposition of a tax, similar to the IBI, on Church property not used for religious purposes, in order to adapt its legislation to EU state aid rules, and in this way avoid any possible fine by the Commission. In May, several Spanish MEPs (Members of the European Parliament) asked the European Commission [es] to clarify whether the exemptions of the Church in Spain are incompatible with the rules set out in the internal market of the EU.

Written by Lourdes Sada · Translated by Alexandra Quinn Global Voices

Social networks have captured information and a variety of comments on the topic. People have become angry after finding out that the Church, owner of the most real estate, does not pay all the corresponding taxes.

@piluquita: ¿Alguien podría calcular cuántas mamografías podrían hacerse con la recaudación de la iglesia si pagara el IBI?

@piluquita: Could someone calculate the number of mammograms that could be done with the takings if the Church were to pay the IBI?

@Tweets_Platino: Rajoy en mayo:”Con los 3000 mill.del IBI de la iglesia no solucionaríamos nada” Junio: el gobierno quita MEDICAMENTOS que ahorrarán 440.

@Tweets_Platino: Rajoy in May:”With the 3000 mill. collected from the IBI tax from the Church we wouldn't solve anything” June: the government gets rid of MEDICATION that will save 440.The Episcopal Spanish Conference has defended the accusations. On its website, an article by Isidro Catela addresses various questions:

So the Church doesn't pay IBI?

This is false. The Church pays IBI on all of its properties that are not exempt by law.

Does the Church pay local council tax?

Yes it pays them (rubbish collection, parking access, etc.). There is no unexpected exemption in the Law surrounding the payment of these taxes.

Who is lying? In reality, everyone and nobody. It's the typical case of information being manipulated so that everyone can work things to their own advantage.

There are a series of buildings that are exempt from paying the IBI tax. In the Church's case, the agreements with the Santa Sede [Vatican] IBI have exempted the buildings dedicated to the intrinsic work of the Church (pastoral, educative, administrative, hospitality, welfare…).

The Patronage Law exempts buildings owned by not-for-profit entities from paying the IBI, except those that have economic activities submerged in other taxes. If we consider, as an example, the new rule from the council of Zamora, see the article in Economista.es [es], it helps us to understand the differences a little more:

(…) the buildings included in the Santa Sede agreement (…) and the Mecenazgo Law (…) will continue to not pay the tax.

It is recognised, however, that this list of previously-exempted buildings has been updated which has resulted in many of them having been removed from the list and consequently now having to pay the tax. This is what has happened with the Cathedral Museum, annex to the Cathedral itself. While the latter may continue without paying, the Museum has started to generate economic activity and therefore must pay the tax.

With regards to the council tax rates, the same article clarifies:

The City Council explained to Economista that, actually, introducing garbage tax now is due to the fact that before the cost was included in the IBI. These church buildings that generate rubbish will have to pay the tax separately now, as before it was taken out and dealt with individually as in other Spanish councils.In brief, it seems that the Catholic Church has been «keeping secret» the payment of the IBI and the council rates of some of their properties. Perhaps it does not amount to a large sum, but in such delicate moments for the economy, when so much is being demanded of Spanish families, it would not be too much to ask that the Catholic Church lead by example and contributed what it should instead of dedicating their efforts in justifying their tax shirking.

With a certain threatening whiff, Isidro Catela, from the Episcopal Conference previously mentioned, says:

The Church is going to continue fulfilling its mision with the means available. Logically, if fewer resources were available, the activities could be affected, but with more or less the same means, the Church is going to continue doing a lot for those that still need a lot.And the web Navarre Church [es] reiterates:

If the law says that the Church should pay the IBI, logically it is subject to the law. (…). It is obvious that the payment of this tax will reduce the Church's resources in order to assist other needs. (…)In reality, the Catholic Church channels the biggest part of its humanitarian activity through Cáritas (Roman Catholic Relief Charity). This organisation, quite unusually, practices transparency, and publishes comprehensive financial reports on its website [es] from recent years, making them available to anyone who wishes to consult them, in such a way that we can see the actual figures, independent of the opinions of critics and defendants.

In this way we can verify that only a very small part of the total funds that Cáritas manages, comes from the church as an institution in the form of contributions from the Interdiocesan Fund and from diocesan organisations.

|

YEAR

|

CÁRITAS TOTAL BUDGET (€)

|

CHURCH CONTRIBUTION (€)

|

|

|

Interdiocesan Fund

|

Diocesan Organisations

|

||

| 2007 |

200,278,373.27

|

327,783.79 (0.2%)

|

2,410,656.08 (1.2%)

|

|

2008

|

216,916,013.54

|

332,168.89 (0.2%)

|

1,641,758.19 (0.8%)

|

|

2009

|

230,017,789

|

298.671 (0.1%)

|

1,878,914 (0.8%)

|

|

2010

|

334,448,494

|

no data

|

no data

|

In the 2010 statement, specific donations from these institutions do not appear, perhaps because they appear in another section, or simply because they do not exist altogether.

In any case, having seen these figures, it does not seem that Cáritas has any reason to be worried [es] if the Spanish councils decide to enforce the Church to comply with their tax obligations.

It should be noted that in February of this year, the Italian government approved the imposition of a tax, similar to the IBI, on Church property not used for religious purposes, in order to adapt its legislation to EU state aid rules, and in this way avoid any possible fine by the Commission. In May, several Spanish MEPs (Members of the European Parliament) asked the European Commission [es] to clarify whether the exemptions of the Church in Spain are incompatible with the rules set out in the internal market of the EU.

No comments:

Post a Comment